Did you know that 75% of nonprofit leaders are expected to leave their current positions within the next 10 years?Transitions amongst executive leaders are occurring at a growing rate as baby boomers are reaching the age of retirement (an estimated 10,000 per day through 2030) and others are leaving the nonprofit sector altogether. Despite these trends, a recent survey by BoardSource reported that only 29% of nonprofits have written succession plans in place.

Whether well-planned or unforeseen, leadership transitions can render significant ramifications for an organization’s present stability and future trajectory. With more than 25 years of experience spanning higher education, program development, and nonprofit advancement, CFA Principal-West Coast Kristin Love offers the following guidance for maintaining fundraising stability during transitions in organizational leadership.

Preparing for Leadership Transitions

Whether anticipated in the near-term or distant future, leadership transitions are a time to focus on sustaining an organization’s current work and most critical priorities. As Kristin shares, “Documenting present-day organizational strategies and accountabilities as well as future succession plans will contribute to increased stability and continuity when change inevitably occurs.”

Development Plans

Formulated through a collaborative process, development plans are an organizational document summarizing quantitative and qualitative fundraising goals, strategies, activities, accountabilities and resources for each fundraising program within an organization’s fundraising team.

Development plans serve as an essential tool for both current and future leaders. As CFA Senior Consultant Rob Ruchotzke recently shared in How Development Plans Can Generate Fundraising Results, “Development plans provide organizational stability and a foundation for future growth by clearly outlining goals and strategies, illuminating key fundraising actions and accountabilities, and defining milestones and metrics.”

Development plans can be a vital resource for new or interim leaders seeking to understand and support core efforts and accountabilities.

Succession Plans

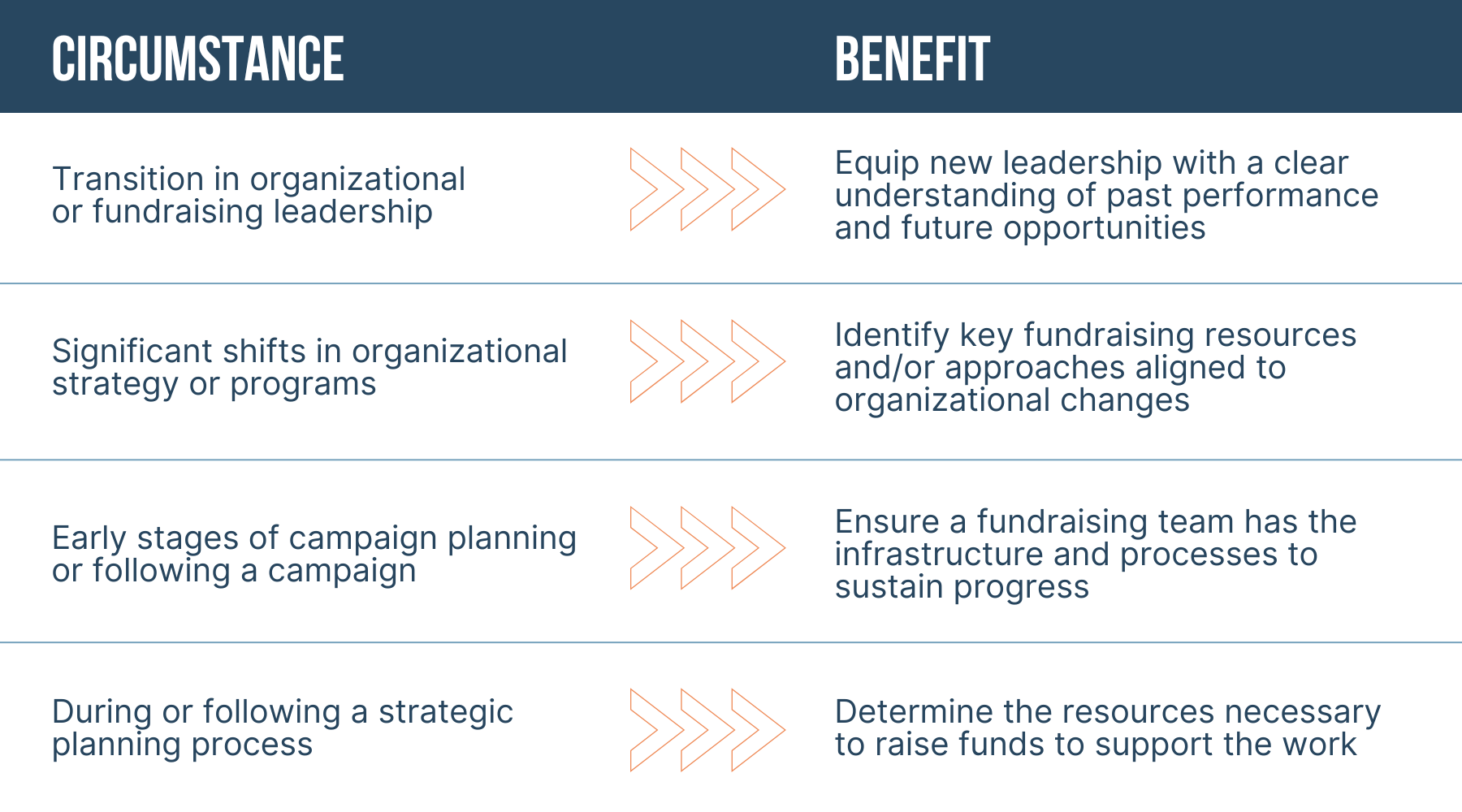

Preparing for leadership transitions through deliberate succession planning will position organizations for increased stability when the inevitable occurs. By folding succession planning into other processes, such as annual planning or multi-year strategic planning, organizations can normalize the process and develop a regular cadence for maintaining and updating plans.

Kristin shares that, “By addressing transitions at every level of an organization, leaders can find confidence in the essential role they play and the importance of sustaining their contributions if and when it comes time for them to transition.”

Communications Plans

The tone, delivery, and cadence of communication is paramount during times of organizational transition. Clear and timely internal communication allows staff the time and space to digest, adjust, and plan for the transition before the news is shared with key external stakeholders such as partners and donors.

When it comes to preparing external communications strategy regarding a leadership transition, Kristin recommends positioning the occasion to celebrate the outgoing leader’s legacy and impact while focusing on the work ahead. “During these moments of significant change, organizational communications should always center what remains constant: their mission-critical work,” shares Kristin.

The departure of a consequential leader presents an important time to engage every level of organizational constituents. Personal contact with an organization’s top donors provides an opportunity to acknowledge the donor’s role in supporting the outgoing leader’s legacy. These connections can also instill confidence in the future of the organization by initiating a strong relationship with the new or interim leader that will shepherd the organization through this period of change.

Pivoting Under Interim Leadership

Interim leaders have a distinct and strategic role to play as their organization searches and prepares for new leadership.

Driving Fundraising Activity

Whether expected or unforeseen, the transition period between leaders can feel like a marathon for staff navigating ambiguity and shouldering additional responsibilities. Through a combination of constant communication and clearly defined objectives, interim leaders can mitigate levels of uncertainty while establishing measurable expectations that will drive activity for fundraising staff.

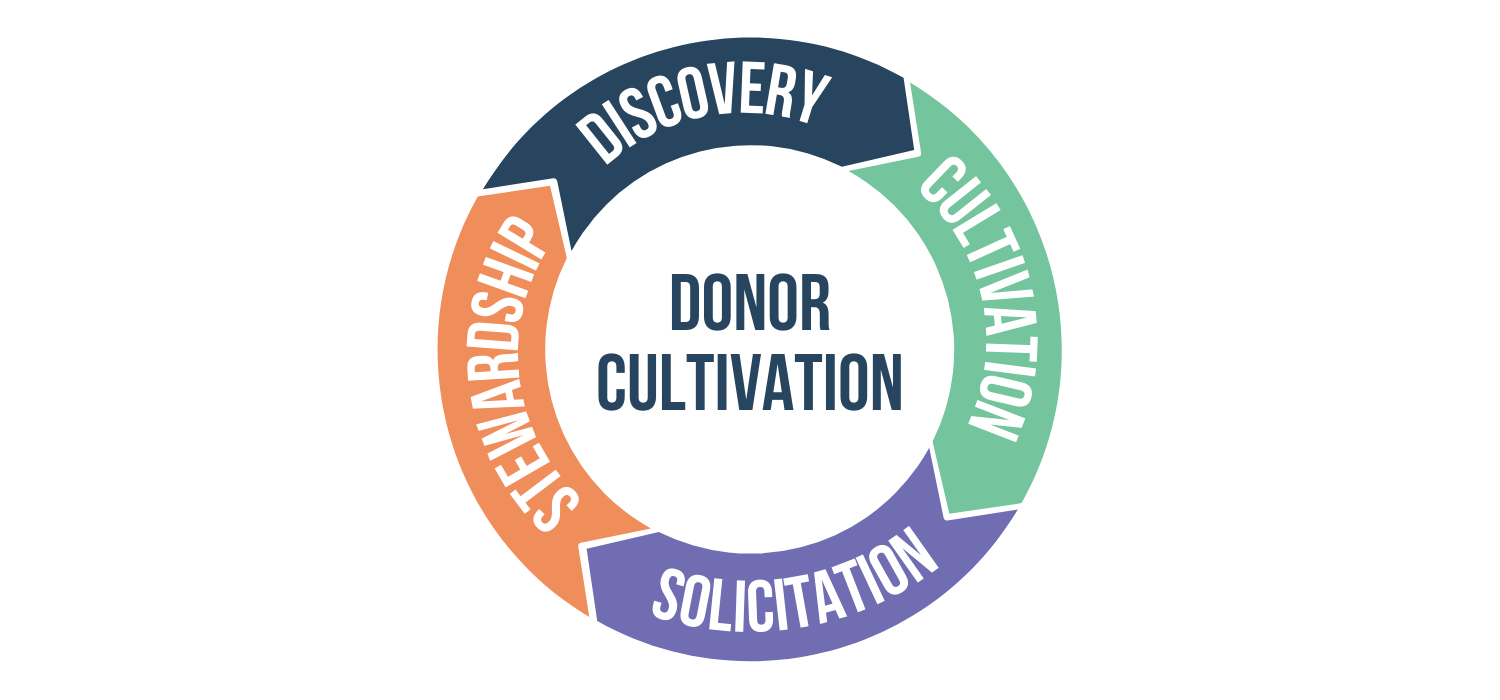

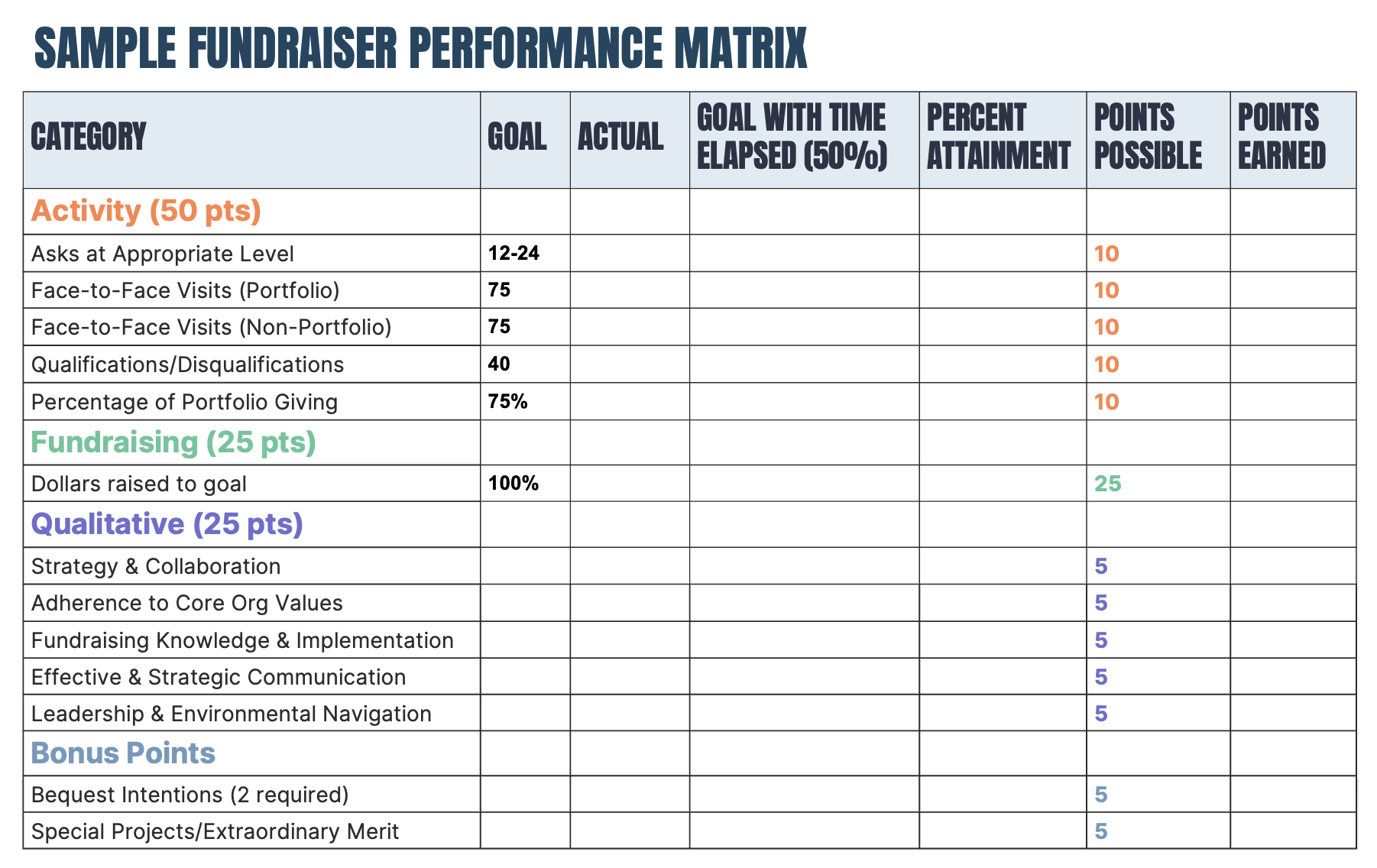

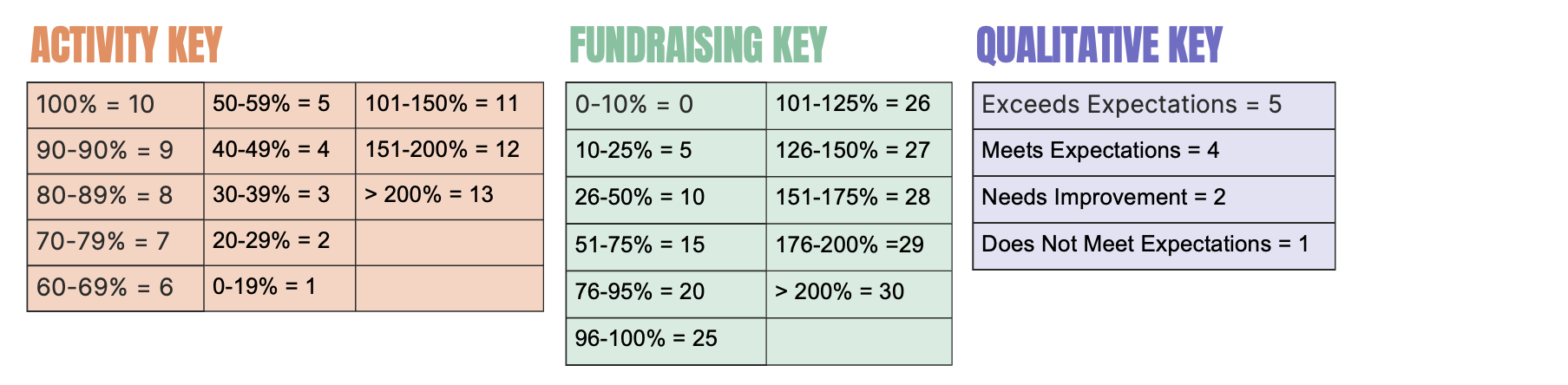

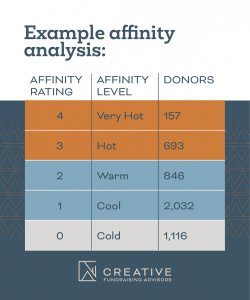

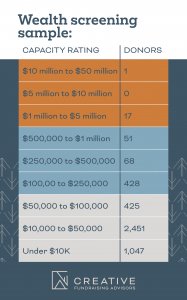

Kristin also advises interim leaders to establish baseline metrics for success that will drive internal fundraising activity while focusing donor support on the organization’s long-term priorities. Rather than focusing on traditional lagging indicators such as dollars raised, Kristin recently shared an approach to activity-based leading indicators featured in a CFA article How Metrics Can Help Fundraising Professionals Reach Their Goals. Leading indicators that can be measured in real time include metrics such as donor contacts, meetings, and qualifications.

In addition to using baseline metrics to shape expectations and drive accountability, Kristin encourages interim leaders to seek out and celebrate small wins along the way. “Leadership transitions can feel stagnant and prolonged, so celebrating progress and productivity can help to reenergize staff and generate a renewed focus on the organization’s future.”

Sustaining Donor Engagement

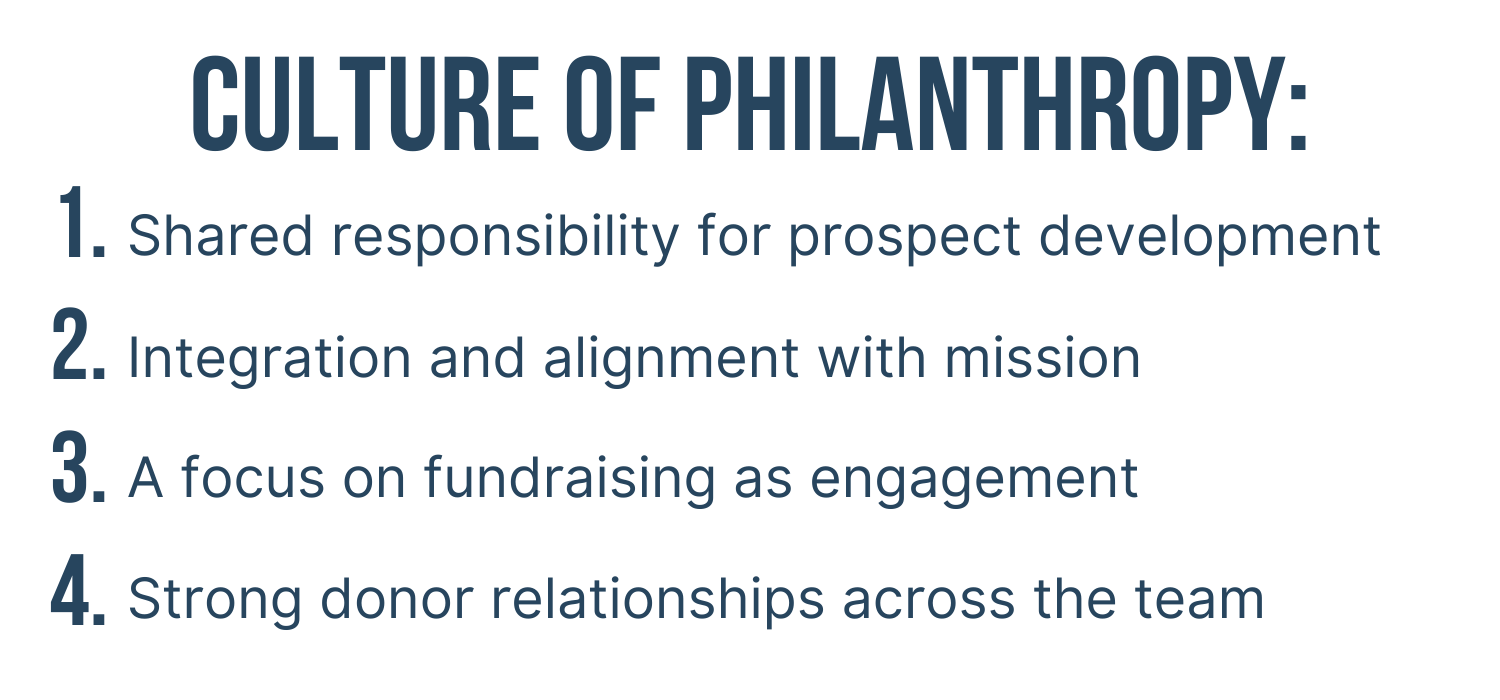

An organization’s prevailing priorities and essential infrastructure become focal points for donor engagement during leadership transitions.

Fundraising conversations can be focused on fundamental investments that will stand the test of time and support continued organizational success under new leadership, such as the annual fund, operations, and core programming. For organizations with an endowment, Kristin shares, “Endowments can be transformational in times of organizational growth and fundamental in times of organizational transition. An organization’s case for directing support to their endowment during a leadership transition is about sustaining continuity of mission and core programs.”

These periods of change can also be an opportunity to introduce other key leaders, including board members or key program experts, to expand donor connections within the organization while creating continuity and increasing confidence. While board members are not always closely engaged in the impact of philanthropy and fundraising for their organization, leadership transitions can represent a significant opportunity to get more involved and contribute to the work ahead.

Excelling Under New Leadership

Well-executed transitions will position an organization to excel under new leadership.

Development Assessments

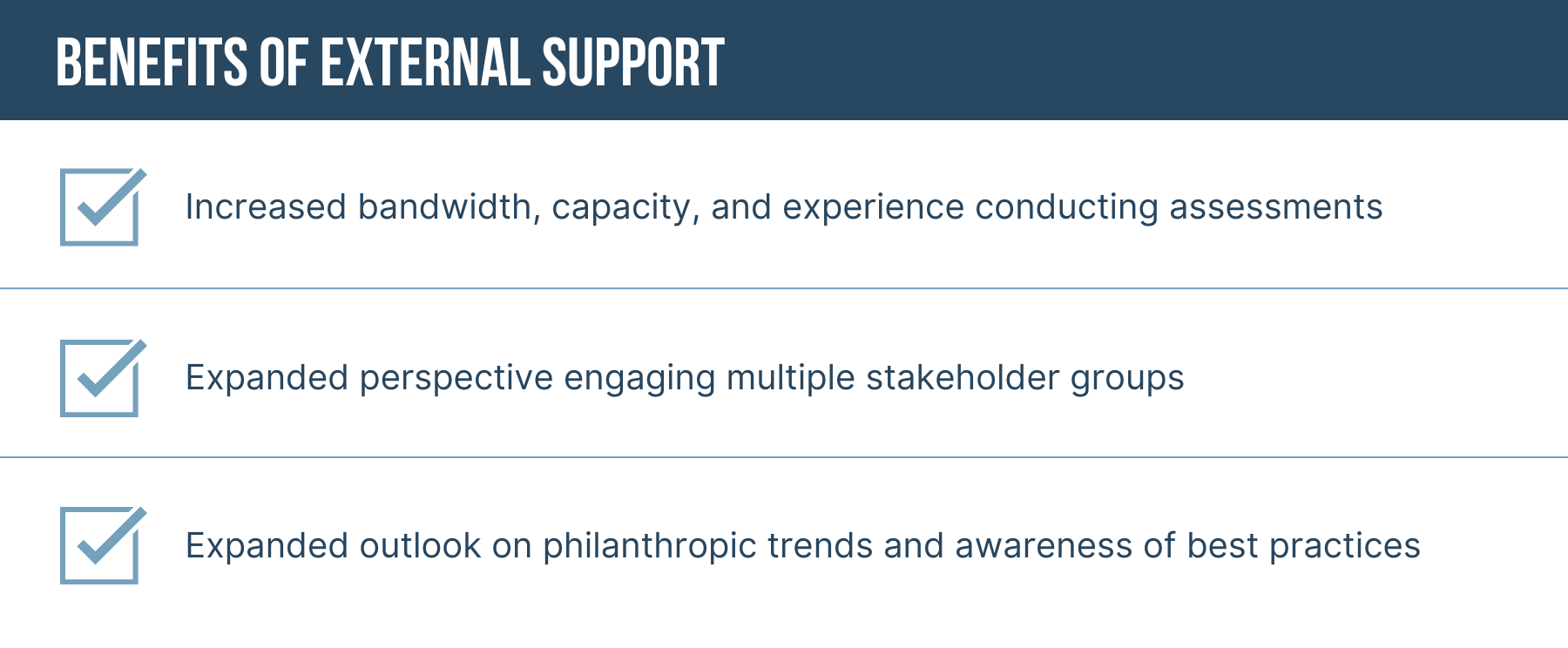

Kristin recommends that organizations capitalize on leadership transitions as an opportunity to baseline on mission, vision, and fundraising strategies. “Development assessments are an incredible tool for times of transition, preparing the incoming leader with an objective understanding of the opportunities ahead.”

As CFA Head of Consulting & Principal, Midwest, Jake Muszynski recently shared in What Is a Development Assessment, and Why Do I Need One?, “Development assessments are a powerful way to energize your organization’s fundraising efforts.” Whether conducted prior to or after the arrival of a new leader, development assessments provide a direct path to actionable strategies that result in more successful, consistent, and sustainable fundraising results.

Envisioning the Organization’s Future

The introduction of a new leader creates a unique opportunity for organizations to revisit their top strategies and renew connections with key internal and external stakeholders. After undergoing a period of significant transition, organizations are poised to invite critical and transparent conversations from key constituents.

As Kristin shares, “Personal introductions to an organization’s top donors are an opportunity for new leaders to listen and solicit advice that can inform the organization’s future vision while sustaining and elevating mission-critical relationships.” By bringing all stakeholders along in envisioning the organization’s thriving future, leadership transitions can be leveraged as a launch pad for new beginnings.

Partner With Us

CFA serves nonprofits across the country, taking the time to learn about their unique challenges and opportunities, and identifying sustainable solutions to advance their missions. If you are interested in exploring how CFA can support your organization through a leadership transition, contact CFA today to see how we can help.

Kristin Love, Principal, West Coast

Kristin is a proven capacity-builder, collaborator, and change-maker in the philanthropic space, with over 20 years of experience in higher education, program development, and nonprofit advancement. Prior to joining CFA, Kristin served as Vice President for Development at Loyola Marymount University in Los Angeles, California. At LMU, she oversaw efforts to evolve development structures and processes to motivate an accountability-driven environment, partnering with academic and administrative leadership to align goals and priorities in pursuit of increased philanthropy.

Before LMU, Kristin held leadership roles in the advancement offices at Colorado College and University of Denver, championing creation of new initiatives at both institutions that integrated engagement and philanthropy. Her career experience includes development roles at large national and small local nonprofits, as well as global organizations such as JDRF International. Her passion for mission-centric fundraising work and the positive impact it can have on institutions and organizations began as a work-study student in the grants office at her alma mater, Baylor University, where she earned a BBA in public administration and Spanish.

A native of Dallas, Texas, Kristin spent over two decades in Colorado before relocating with her family to the Los Angeles area in 2020. The mother of 15-year-old twins, Kristin enjoys watching her daughter’s athletic pursuits, and son’s music and acting endeavors. In her free time, she can be found traveling or at a potter’s wheel.

Email Kristin

Kendall Carlson, Content Writer

A frequent contributor to CFA’s digital content, Kendall Carlson has spent her career advancing nonprofit organizations across the Twin Cities. With 16 years of experience, Kendall brings a balance of strategic and operational leadership spanning fundraising, program development, evaluation, and strategic planning.

Most recently, Kendall served as Development and Communications Director at Hired, where she diversified revenue for the organization’s $11M budget and increased individual giving by 60%, led a rebrand, and launched an organization-wide data for impact initiative. Prior to Hired, Kendall served at Greater Twin Cities United Way, where she led an advancement strategy team to increase investment and engagement from the organization’s top corporate and major donors. Kendall is known as a strategic, solution-oriented leader with a high capacity for detail and commitment to quality. She launched her consulting practice, Luminate Consulting, in 2022 to bring her skills in fundraising and program strategy to nonprofits seeking sustainable growth.