Building a Harmonious Relationship Between Fundraising & Finance Teams:

A Story of Unified Revenue

At a regional children’s museum known for its hands-on approach to learning, creativity had always been front and center. Children built bridges from wood and wire, experimented with pigments and textiles, and explored inventors’ labs designed for curious minds of all ages. The museum’s revenue model was as dynamic as its galleries: memberships, gift shop and café sales, tuition-based craft and maker space classes, annual giving, and major gifts from committed stakeholders.

Behind the scenes, however, the museum had been grappling with a challenge familiar to many nonprofits—one that rarely appeared in program evaluations or visitor surveys. Development and Finance were operating with two different pictures of revenue.

When Idris* joined the museum as director of development, he stepped into a fundraising operation that was outwardly successful but internally fragmented. His predecessor had been an exceptional fundraiser, adept at cultivating relationships and closing gifts. Communication with the Finance team, however, had been inconsistent. Reconciliation was frequently postponed for months and, in some cases, years, turning the close of the fiscal year into an exhausting ordeal.

Leila*, the museum’s chief financial officer, had experienced the consequences firsthand. As the executive responsible for financial systems, internal controls, and reporting, she understood that when Development and Finance worked in silos, clarity suffered. Her goal was not to slow fundraising or introduce unnecessary bureaucracy. She wanted one shared, accurate picture of revenue—something the organization could trust for planning, governance, and accountability.

Two Departments, Two Versions of the Truth

Development tracked revenue through their fundraising database: memberships, donations, grants, and multi-year pledges. Finance focused on deposits into the bank account. Both perspectives were valid. Both were incomplete on their own.

Admission revenue flowed through online payments and the front desk. Tuition for maker space classes was processed through a separate registration platform. Gift shop and café sales posted daily. Major gifts arrived by mail, wire, or donor-advised funds. Without regular alignment, unresolved discrepancies accumulated. Development often believed revenue was ahead of pace, while Finance saw delays in cash flow. Finance flagged variances that Development struggled to explain weeks—or months—later.

CFA Head of Client Success and Principal Joanne Curry is all too familiar with this scenario: “This is one of the most common operational challenges we see. Development and Finance are each doing their jobs well, but they’re looking through different windows of the same story. Until those views are merged, confusion is inevitable.”

- Check out a recording of CFA’s Finance for Fundraisers webinar for more tips from Joanne.

Starting with Purpose, Not Blame

Rather than focusing on what had gone wrong, Idris and Leila chose to reset the relationship between their departments. The museum had grown in complexity, and its internal systems had not kept pace. What once worked was no longer sufficient. The two aligned around a simple principle: there needed to be one revenue story, jointly owned.

To design a system that reflected reality, they consulted broadly. Front desk staff described how admission tickets were processed during peak attendance and on weekends. Educators explained the seasonal nature of class enrollment and tuition payments. Operations staff outlined the daily logistics of mail handling. The bookkeeper identified where delays and confusion most often occurred. These conversations grounded the solution in practice rather than theory. The goal was not perfection, but consistency, transparency, and shared understanding.

Building a Daily Revenue System

The system Idris and Leila implemented shifted reconciliation from a periodic crisis to a daily discipline. All revenue—gifts, memberships, tuition, shop sales, and café receipts—was logged daily in a centralized revenue log. Staff responsible for opening mail or processing transactions recorded payments immediately, following clear, written procedures.

Development entered all philanthropic revenue into the database promptly, using consistent coding for funds, restrictions, and appeals, so donor intent was captured accurately from the start.

Finance reviewed daily deposits and compared them against the revenue log and Development entries. Discrepancies were identified the same day. A missing check, a delayed deposit, or a coding error could be resolved while details were still fresh.

Idris and Leila held brief, standing check-ins—often just 10 minutes—to confirm that daily totals aligned. These conversations were operational and collaborative, focused on accuracy rather than fault-finding.

Joanne points out, “Daily reconciliation takes the emotion out of the process. When issues surface quickly, they’re easy to fix. When you wait weeks or months, reconciliation can become personal, political, and unnecessarily painful.”

Checks, Balances, and Oversight

Strong internal controls were built into every step of the process. Revenue was handled collaboratively from start to finish, with responsibilities shared across teams to ensure accuracy, transparency, and accountability at every step. These checks and balances protected both the organization and its staff. They reduced risk, strengthened audit readiness, and reinforced a culture of shared responsibility.

Leila served as the owner of this process, responsible for ensuring that Development and Finance remained aligned and that the system functioned as a single, integrated whole. Procedures were documented, and responsibilities cross-trained, so institutional knowledge would not disappear with staff turnover. The system was also designed to scale, accommodating growth in programming, attendance, and fundraising without breaking down.

The Benefits of One Shared Revenue Story

The results were immediate. Month-end closes became smoother and faster. Finance committee meetings shifted from troubleshooting discrepancies to discussing strategy. Development reports aligned with financial statements, strengthening credibility with leadership and the board.

Idris gained the ability to spot trends early. When annual appeals slowed or membership renewals softened, he could adjust outreach before small issues became serious challenges. Leila gained clearer insight into cash flow, improving forecasting and financial decision-making.

Communication improved across the organization. Staff understood how their daily work affected financial health. The board received consistent, reliable information, reinforcing trust.

Joanne adds that “When Development and Finance are aligned, there are no surprises. You can communicate confidently with the finance committee, the development committee, and the board as a whole—and you avoid the impossible task of reconciling a year’s worth of activity all at once.”

From Annual Ordeal to Everyday Practice

By year’s end, reconciliation was no longer feared. It had become routine—embedded in daily operations rather than deferred to a stressful deadline. For the children’s museum, the outcome went beyond cleaner books. The organization gained confidence that every dollar entrusted to it was accounted for, respected, and put to work expanding creativity, curiosity, and learning for the community it served.

Partner with Us

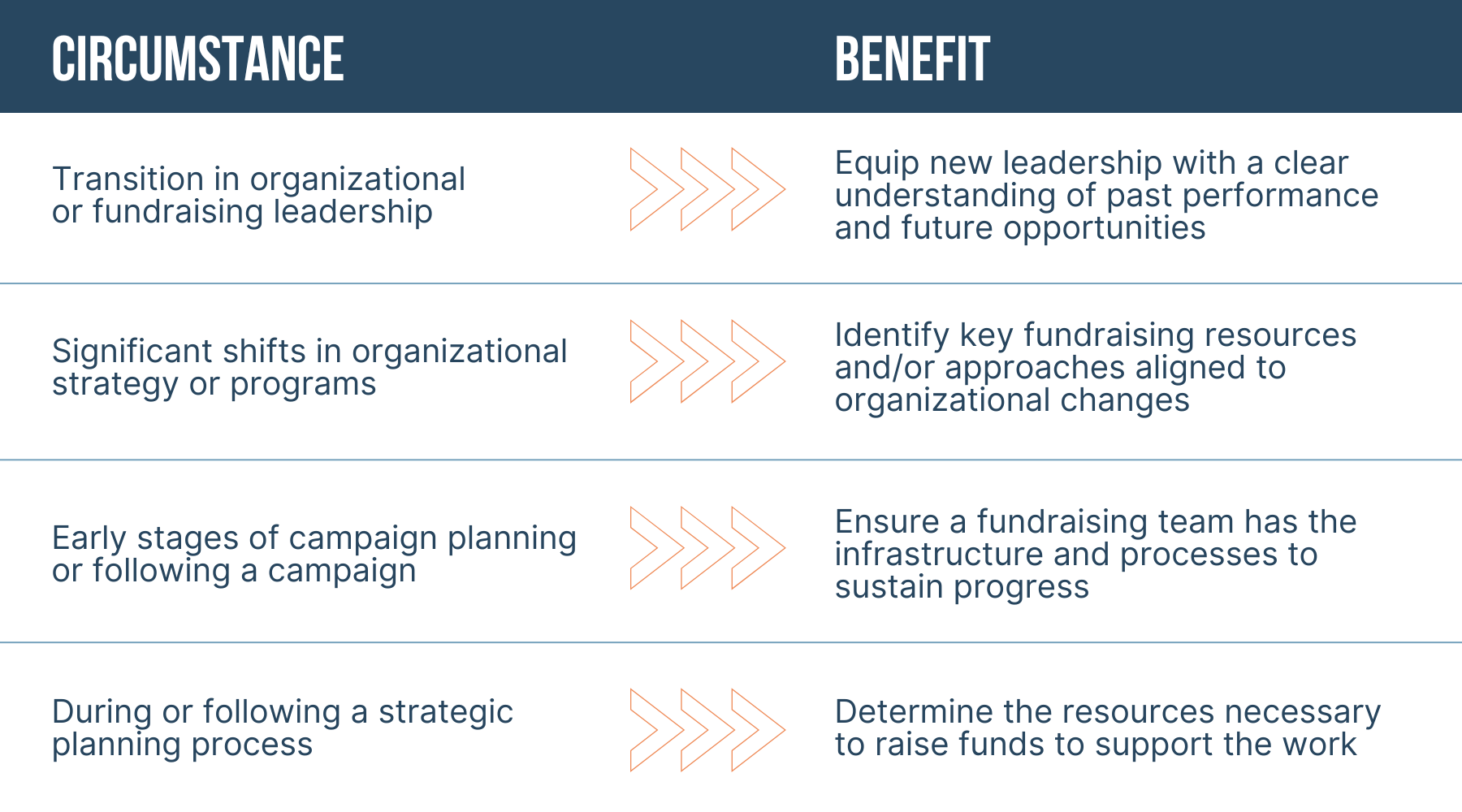

Do your Development and Finance departments struggle to align? CFA’s Development Assessment is specifically designed to help organizations evaluate how their fundraising strategy, staffing, systems, and cross-department communication function in practice, including how revenue is tracked, reported, and reconciled. By identifying gaps and recommending practical improvements, the Assessment strengthens internal coordination, improves confidence in reporting, and helps leadership and boards make better-informed decisions.

Contact us to find out how a Development Assessment can help your organization build one clear, shared revenue story.

*Disclaimer: Client confidentiality is paramount in our work with each and every organization. The story in this article is fiction, based on real situations drawn from CFA’s broad experience serving nonprofit organizations.

Leslie Cronin, Senior Manager of Strategic Communications

Leslie Cronin comes to Creative Fundraising Advisors with broad experience in education and nonprofits. Early in her career, she taught English, composition, and creative writing at selective independent schools, colleges, and universities. In 2005, she became Senior Development Writer at the Museum of Fine Arts, Houston, overseeing all aspects of communication coming out of the museum’s development department including exhibition descriptions, grant applications, correspondence with major donors, acknowledgements, and event invitations.

Leslie later brought her experience in education and fundraising to a new role, serving first as board member and then vice president of the board of an independent school in Houston, Texas. During her tenure, she was instrumental in the formulation of the school’s 20-year plan, including its successful accreditation as an International Baccalaureate institution. She worked closely with a wide variety of consultants on urban planning, architecture, and a fundraising feasibility study. Her insight into the client experience helps her every day in her work for CFA.

As Senior Manager of Strategic Communications, Leslie helps CFA’s clients shape their campaigns for maximum impact and results by leading case development workshops, writing compelling case summaries, and crafting powerfully persuasive campaign collateral. Additionally, Leslie manages CFA’s brand voice by developing content for the firm’s resource library and overseeing the editorial calendar.

Leslie believes nonprofits have the power to change the world. In crafting cases for support, she writes as a committed advocate for each client and their goals. Leslie holds two Masters degrees, one an MFA from the Iowa Writers’ Workshop, the other an MA in English Literature from Temple University. She is mother to two grown children, a voracious reader, and an amateur equestrian. She lives on Cape Cod with her husband, author Justin Cronin, and their rescue dog, Lonesome Dove.